In Economically Perilous Times, How Can Accountants and Financial Services Help Their Clients?

With the cost of living skyrocketing and the very real necessity for the poorest in our communities to choose between whether they can afford to heat, or eat, it’s more important than ever for accounting and financial services to be providing the right support and advice to their clients.

That's why we've created this article to give you some helpful tips on how to best provide reassurance and support to your clients when it starts to feel like we're all building on shifting sands.

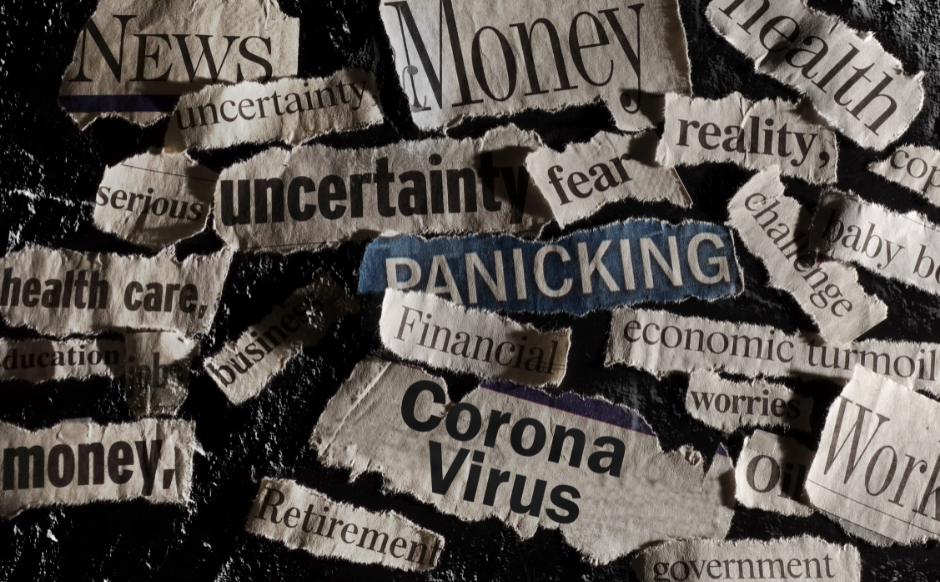

When financial uncertainty hits, it can inspire panic and confusion, especially in those whom it will most impact. Some people will look for reassurance that it won’t affect them in the future, which is of course, understandable.

When lockdowns created uncertainty and fear over people’s income and investments, many firms who deal with finances found that their email inboxes were filling up faster than they could respond, and their phones started ringing off the metaphorical hook. If you are an accountant, carry out payroll duties within a business, or are otherwise employed in managing or organising other people's finances, then you'll know just what we mean. When the morning news reports a hike in oil prices, hints at the possibility of a petrol shortage, or forecasts soaring food prices, the panic it inspires in some people results in genuine chaos.

We watched in horror as the rumour of a UK fuel shortage in 2021 became a self-fulfilling prophecy as people rushed to the pumps in response to the news. Fear of the unknown can create a very real problem.

What can break the cycle of anxiety, panic, and rash action is a sensible word or two, said with authority and people know this. That’s why the first thing they do at the first hint of a tale of financial doom is call their accountant. In most cases, a bookkeeper or payroll professional won't be much more able to predict the national interest rates of the future or be able to tell you whether the property market is stable than anyone else.

Our point is that when people are afraid, they call their advisors. In many cases, that is their accountant, bank, mortgage broker, or in some cases an Independent Financial Advisor (IFA).

Whoever, you are to your clients, there are a few things you can do as an individual or as a business that can help soothe your clients' anxieties over their financial futures.

Be Patient

It's not always easy to make time for every little client query or worry, but setting aside time to really listen to your anxious customers and not rush them, can be the most helpful thing anyone can do for them. If you are the CEO of a large accountancy firm, then, of course, you know you don't have time to talk to every individual customer about their concerns. However, pledging to take on one call from the help desk every day can really help allay doubts that your large company doesn't care about small businesses, sole traders, or individuals and soothe their anxieties. So, why not book off fifteen minutes to talk with your clients each day without trying to upsell them any of your services, but just to really listen to them.

Be Authoritative

You have the unique qualifications to be able to give advice to your clients that they will genuinely put stock in. They called you because they trust your assessment of the situation and you should never forget what an honour and what a responsibility you have in that trust. If their worry is over VAT or tax increases, then you likely will be able to advise them on whether their concerns are warranted and what can be done about it, if anything. It's likely that any rumours of changes to tax return procedures or HMRC codes will spark worries in many small businesses or even large businesses. The important thing to remember when advising your clientele is that you are the one they came to because they trust you.

Be Proactive

One thing you can do to help your own team and your clients when you face a collective period of financial uncertainty is to approach those clients who you think will be most affected by whatever news has struck before they come to you. We think it's fair to say that barely a year (or a month) goes by without some cut to funding, change to benefits, or rise in commodities being announced and each piece of information that drops will affect different groups of people in different ways. You will know who will be most concerned by the national insurance rises, interest rate variations, or changes to HMRC taxable income amounts.

The same concern that affects sole traders and small businesses, won't necessarily threaten a large corporation and vice versa. Still, following those trends and forecasts can help you to be proactive in reaching out to the individuals who need your support and the support of your services the most. That is the sort of human kindness, that customers will not forget in a hurry.

Be Organised

All of these suggestions so far are likely to be time-consuming for you and your team so you'll be glad to hear that this next one should help you to free up some of that time by improving the efficiency of your daily work practices. Whether you're a dedicated accountant, chartered accountant, an accountant in practice, IFA, a mortgage broker, or a bookkeeping professional you'll almost certainly be concerned about filing. If you use a paper filing system in your office then you'll be well aware of the drawbacks, especially when working out of the office as covid forced us all to do.

With hybrid working now the new normal, there's no sense in pretending that you don't need a dedicated document management system to help organise and automate time-consuming administration tasks that bring you neither profit nor joy. Trust us, no one misses the arduous task of filing or the frequent trip to the cabinet or printer when they go paperless. Going paperless, or part-paperless can save you and your team so much time and effort. Not to mention money. Those resources can surely go towards better serving your clients in times of trouble and carrying out more valuable work yourself.

Be Human

This tip is by no means restricted to the accountant population, or those in the finance sector, but anyone can help another human being by listening to them, acknowledging their feelings and responding in a human way without guile or agenda. Business is business, and we understand that, but you are a person and so are your clients. An organisation, company, or business is just another name for a group of people. So be human when you're dealing with a client who is frightened about the future. No matter if their concern is cash flow, UK tax, interest rates, or the cost of simply living, those who show empathy also show great leadership and that is important in uncertain times.

Final Thoughts

As we've mentioned before, people seek help from trusted sources when times get tough, or uncertainty threatens their harmony. In this time of QuickBooks and other accountancy apps that claim to help a sole trader or small business to take care of their own tax without so much as a need to open their desktop browser, there are two main reasons they stay with their accountants. The first is the effort it would take to do their own bookkeeping and the second is loyalty due to experiencing a truly personal service.

The Effort Element

The concept of the boomerang customer is as familiar to you as it is to us. Many think they could do a better job themselves or with a competitor and often come flying back after experiencing the alternatives. The truth is that unless you began an accountancy firm, you probably didn't hope to be filing tax returns, storing every receipt, and fiddling with VAT deductions for a lot of your day. Most people start businesses to do more...well, business, not accountancy. As we say, accountant practices are the exception to this.

Often a client will underestimate the bother and fuss of doing their own books or planning for their own financial future. We're sure you, who have the right qualifications and expert knowledge, welcome the boomerang customers back graciously when they hurtle back into your office.

The Personal Element

As with any successful business, the key to reduced customer churn is great customer service. This might seem a strange consideration when you know full well that 90% of the work carried out per client is behind the scenes, as it were. This makes the customer-facing element of your day to day business all the more vital to instil loyalty in each client.

Even in the accountancy business, the personal element shows clients that you care about more than just their money, but about them. This personal element and an aspect of empathy of financial advisement and accountancy is what really turns customers into loyal clients and then into brand ambassadors for your company. There is no better marketing than word of mouth, after all.

Frequently Asked Questions

Why Should Accountants Use a Document Management System?

Document management systems (DMSs) can assist an accountant throughout the business life cycle of a client and allow you to maintain high levels of efficiency whilst keeping your clients happy. This can also helpfully reduce the inconvenience of human error. Nothing is more embarrassing than to have to admit you have lost a client's vital paperwork. Filing errors will also not impress an audit officer, but Document Management Systems help accountants to remain compliant with current data storage laws.

A good DMS will allow you to search and find documents even if they have been electronically misfiled or even deleted by mistake. They will also capture email information that is relevant to a case or client and will automatically file it in the appropriate place, so you can view relevant correspondence in chronological order. Great Document Management Systems or software will help your office reduce waste, save money on printing, and reduce the time spent on high-effort, low-efficiency administration tasks that could be automated.

What is the Best Practice Management System for an Accountant Practice?

Practice management systems or CRM tools can help you record key information about clients including who they are, how long they have been clients, and how to contact them. They also clearly display what work you have done for them so far and what still needs to be done on their behalf. Your clients might be small businesses, individuals, or large companies, but a PM system will record all of them so you can efficiently manage and prioritise your practice workload. These systems are sometimes called client workflows because they track and record the progress and direction of the tasks assigned to the case.

Some of the common Practice Management systems for accountancy practices are Wolters Kluwer, Star Practice Management, Thomson Reuters Digita, Iris Practice Management, and Tax Calc. Having worked with the accountant sector for many years, Virtual Cabinet DMS integrates with all these major PM systems and many more. So, you can be sure Virtual Cabinet will work with the systems that already work for you, not against them.

How Can Accountants Increase Tax Efficiency?

Every accountant has periods where they are extremely busy because of tax return and HMRC deadlines and the same goes for bookkeeping professionals. It's particularly vital that when these intense times approach, your software and office procedures are correctly in place and able to cope with the increased workload. Having a Document Management System and Practice Management system that works for you and with each other is so important to getting work done efficiently and in time for the appropriate HMRC UK tax return deadlines. Each accountant and accountancy practice will have a different way of working through their workload, but as long as you have systems in place that work for you and your team, you should be work efficient and this will help you ensure tax efficiency.

Having a capable PM system is one way that will help you to be efficient in your busiest seasons, but many accountancy software also has inbuilt algorithms for helping calculate the least amount of tax you or your client will have to pay to HMRC. Keeping your software versions up to date and keeping your own knowledge up to date is the easiest way to ensure tax efficiency.